So, being a professional services company, you have completed all the crucial stages in the sales cycle and got the deal. The next process is always about invoicing.

Invoicing seems like a simple process of listing the products/services and its prices, but in reality, it is much more than that!

The best way to define invoice is by calling it an accounting document, issued to the buyer as a request to make the required or pending payment. Hence, your invoice also becomes part of your business representation.

Hence, a perfect invoice not only has all the financial details, but it also presents its details in such meticulous ways that the document reflects a spirit of transparency and professionalism. So, invoicing is very important and should not be taken lightly.

Today we will talk about the challenges faced when generating an invoice and how you can overcome this via the Zoho One applications.

A professional services company differs from other businesses, probably because of its intangible nature and its ability to cater to the unique needs of the customers all around the world.

Hence, the invoicing process comprises distinct features, which are crucial to address and can also be challenging to keep pace with.

So, let’s list down 5 challenges that professional services companies face while drafting an invoice.

As mentioned before, most professional services companies work around the globe in an hourly model. So, all your invoices must have a systematic break-down of the prices based on this hourly model.

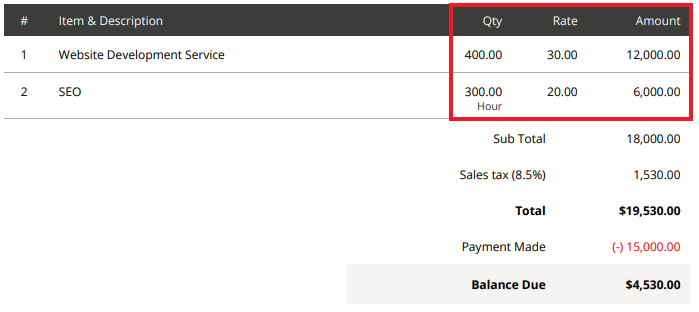

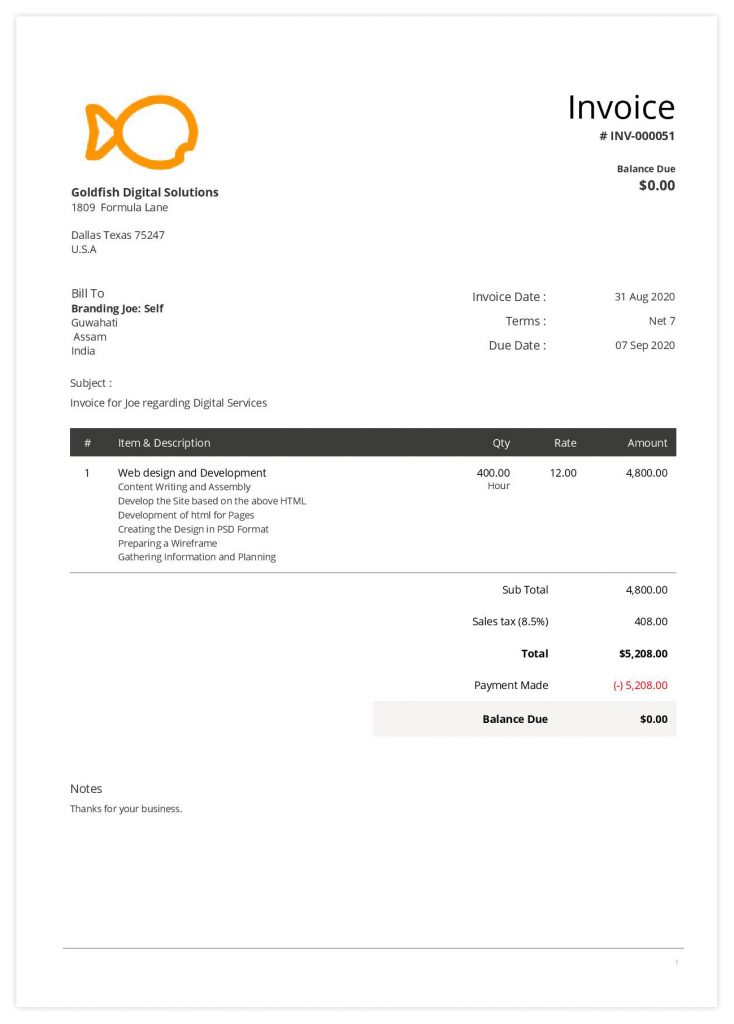

For example, when we generate an invoice for our customers, we always base the total prices on the total hours needed by the particular service. This is how the billing section of our invoice looks:

Hence, if you are manually invoicing, then it becomes really taxing to maintain the hourly bill with all your customers. Also, there is always a possibility of drafting an invoice that might have miscalculations and other discrepancies, which can make your business look unprofessional.

If you are using a tool to generate invoices, then you have to optimize your tool with this billing system, to make sure that it correctly generates the total amount based on the total hours of the services.

Let’s first understand that in this highly interconnected world, services in a B2B domain are not restricted to one geographical location. Especially with a professional services company, you have customers coming from different parts of the world.

So, your invoicing process must accommodate suitable currencies based on the geographical location of the client.

This factor is often overlooked, but it is very important; because it makes the transactional values clear to understand and takes away the headache of sitting with a currency converter.

But now the real problem lies in creating multiple invoices for multiple customers originating from different parts of the globe.

To meet this situation you must have a system in place or a tool that has the feature to support multiple currencies and can translate the amount under the specific currency.

Flexibility with payments is the chief asset of every professional services company. Hence, in most cases, your customers will make the full payment in milestones.

So, when invoicing, you have to constantly update the document with the payment received and the payment due. Hence you have to track and monitor the payments of each customer and take follow-ups.

This becomes tough when you are dealing with multiple invoices, having multiple due dates. Especially when you are monitoring the payments manually on an excel sheet.

With an excel sheet, you are bound to make mistakes, because it is not possible for the human eye to perfectly manage all the financial details and constantly keep up with the invoicing process.

Even if you or your team are really meticulous with the work, there’s always a chance for human error.

In such a case, you need a tool or a system that does the job for you and automates the invoicing process with the required updates.

In today’s world, there are multiple payment options through which we can receive payments.

Professional services companies are no different. Hence you can receive the payment via cash (although not very common nowadays), cheque, direct bank transfer, or through the online gateways.

So, there are many ways to receive payments. Hence sometimes there can be additional charges added to the payment. This specially takes place when customers make the payments via the online payment gateway. This mode usually incurs extra charges that get added to the overall payment.

The sudden change in the transactional values becomes difficult to keep track of, especially when you are maintaining your accounts.

To keep track of these changes manually, based on different payment modes, is definitely a pain that needs a proper tool to resolve and maintain.

I know you must be wondering that you have already cracked the deal and you no longer have to maintain the company’s brand image. After all, invoicing is all about collecting money.

But that’s not true. Even your invoice must reflect your brand persona and constantly remind the customers that they have come to the right place.

Hence, aesthetics is really important. Because, by aesthetically representing your invoice, you can make this transactional document interesting to look at, giving out a vibe of professionalism.

When you want to expand your business to become a well-known brand, be particular about the look and feel of all the visual aspects of your business. This also includes all the official documents. Because aesthetics is the key to building brands and establishing this identity in the customer’s mind.

Being a professional services company, streamlining your invoicing process can be challenging. As you have to be accurate in generating an hourly bill, synced with the specific currencies of the customers. Also, you have to track and monitor all the payments and maintain your accounts to calculate the monthly reports and ROIs.

I know it seems hectic, but I have just the right solution for you.

With Zoho One applications, you can turn the table and manage your invoicing process with a snap of your finger.

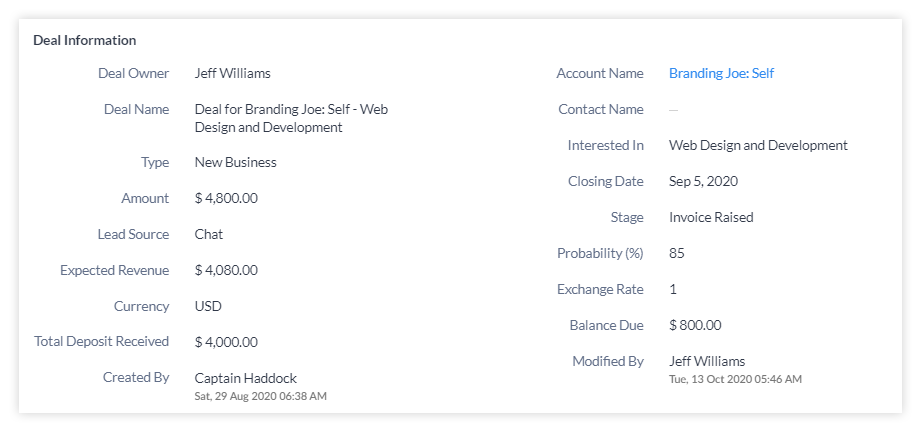

So, once you’ve completed all the stages required in the sales process which involves talking about the requirements and solutions, generating proposals, and finally getting the approval, the next stage is about invoicing.

Having all the information stored in your CRM system, you can generate an invoice with just a click. While raising the invoice, all the information will be automatically transferred to Zoho finance applications.

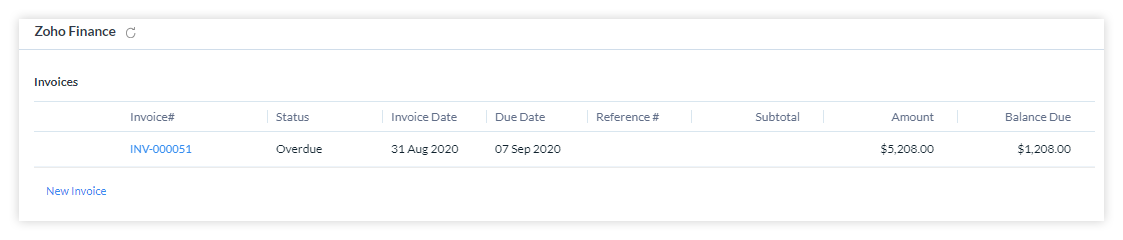

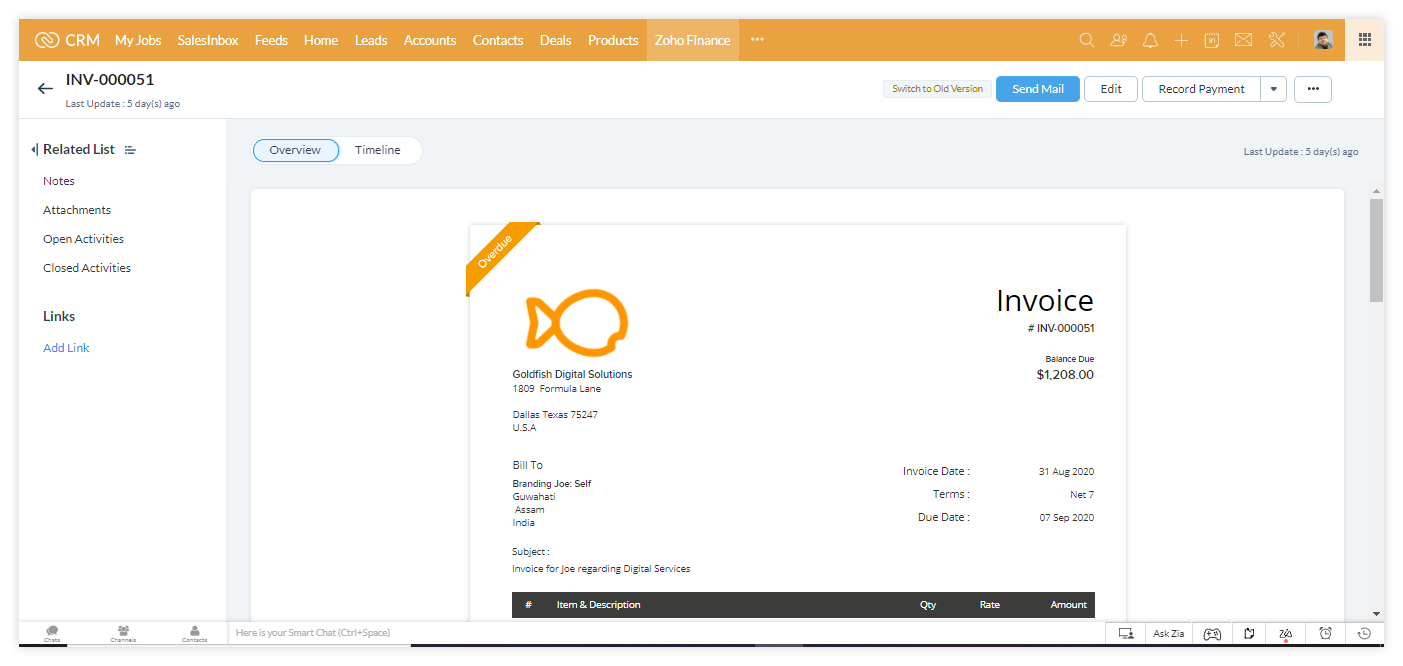

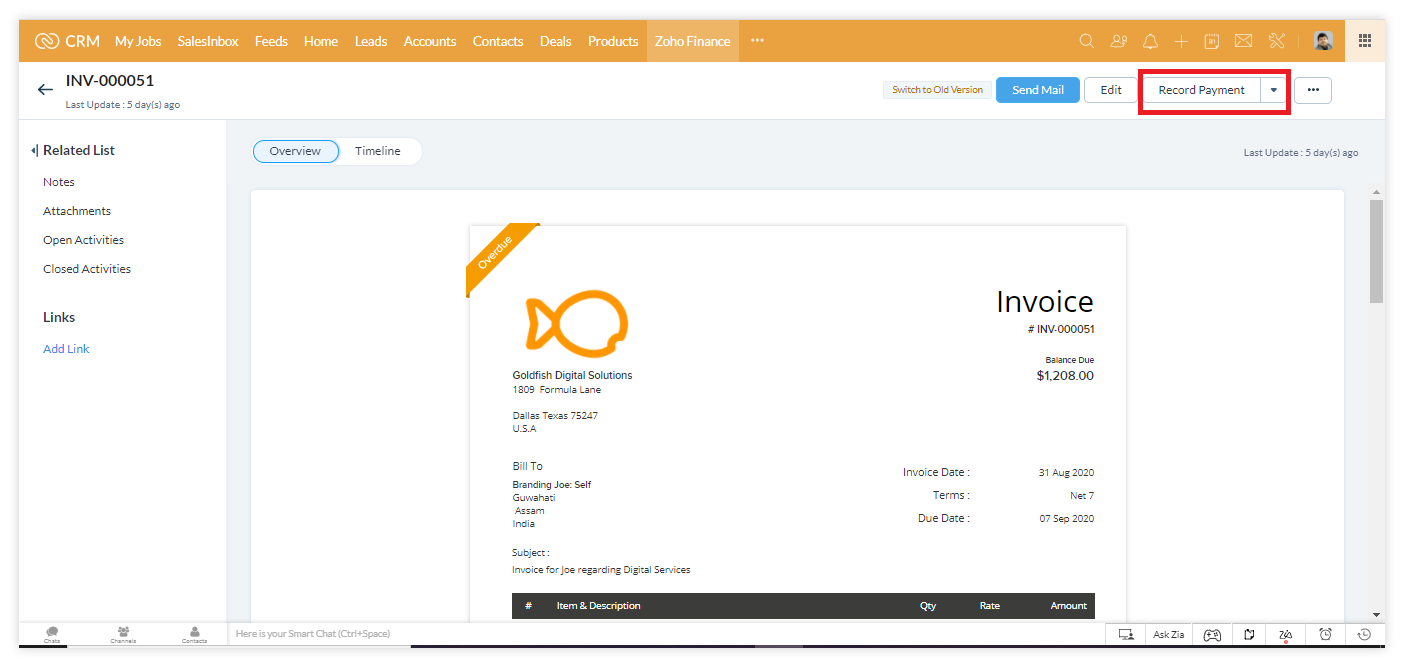

As you click the invoice number, you will get redirected to another page that will show you the entire invoice.

Also, if you have to update or track any pending payment, you can easily do so by clicking on the “Record Payment” option at the top-right-corner.

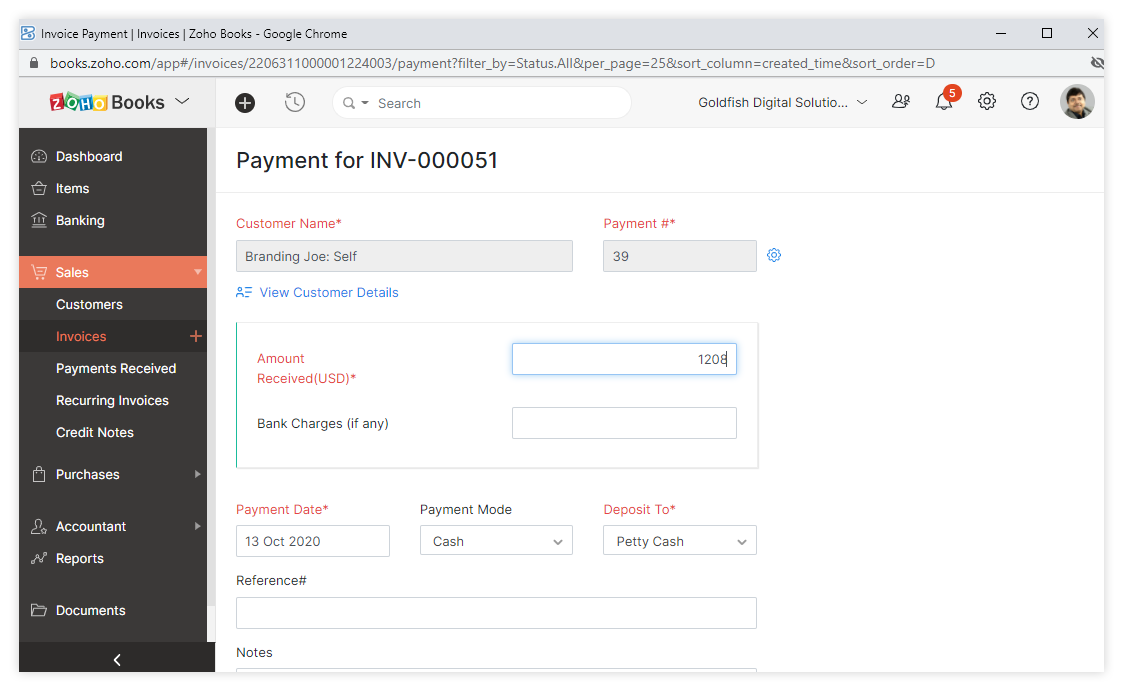

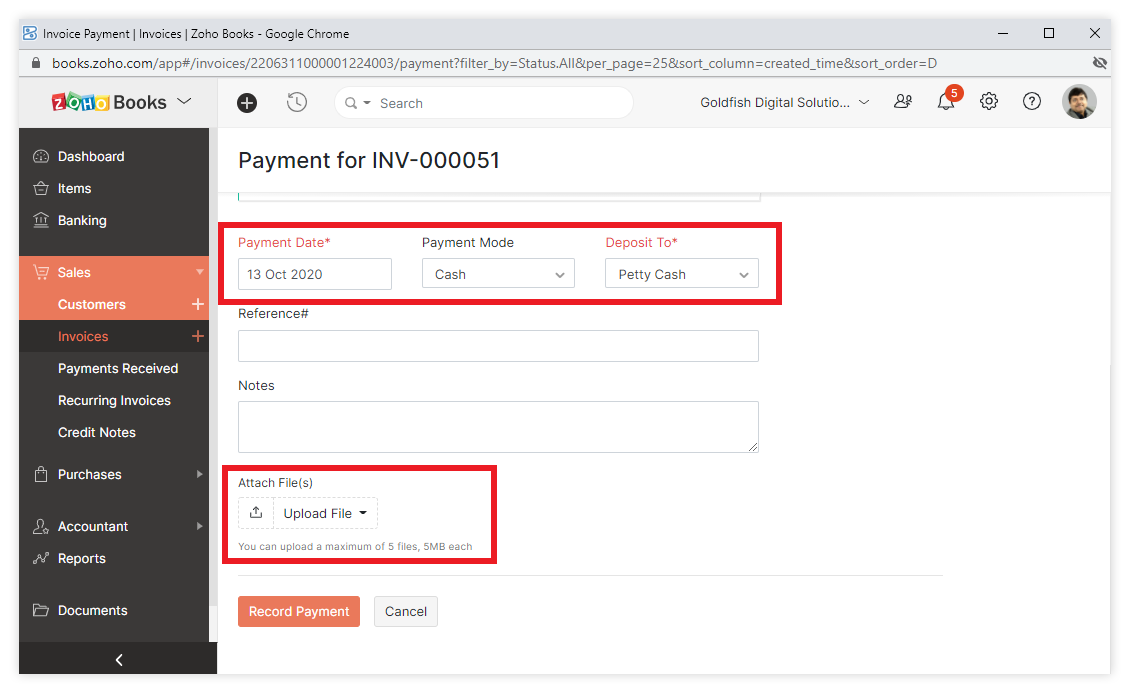

After clicking the button, this document will open automatically in Zoho Books, where you can update the following changes:

As you can see you can record the payment amount, which will get reflected in the current invoice. Moreover, in Zoho Books, you can also select the payment mode, and track the extra charges that the transaction might incur.

You can also upload any document which might give you more insight into the transaction.

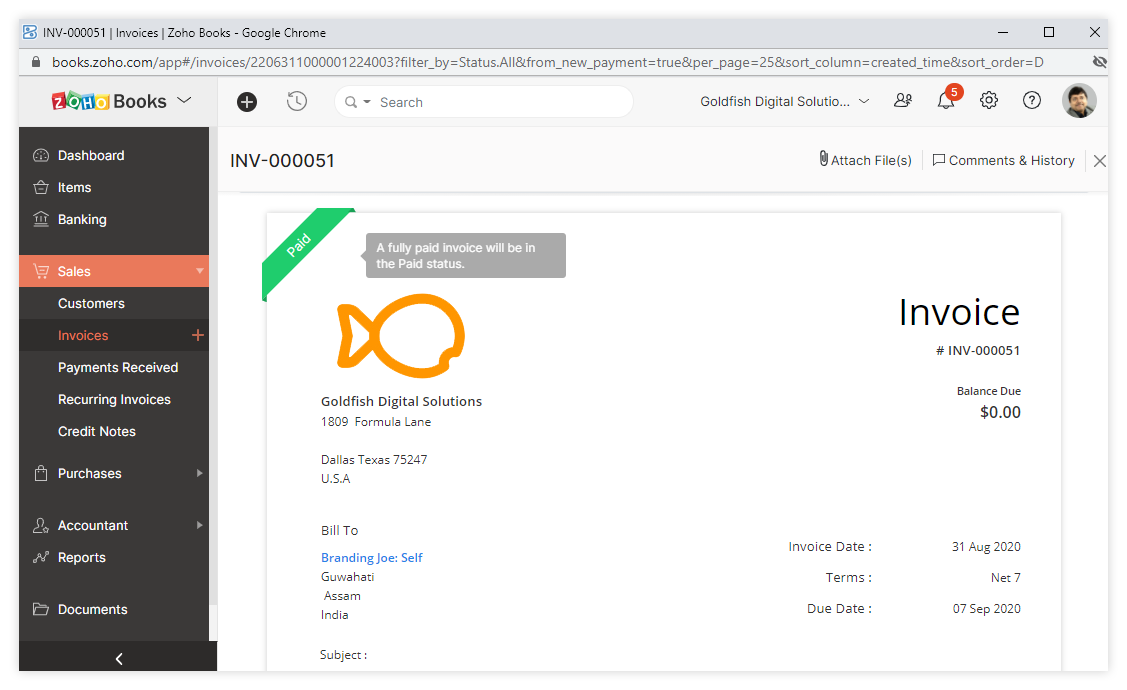

After your clients make the payment, the invoice will automatically get updated showing an overall due (if any).

For example, in this transaction, the customer has paid the total amount for which it leaves no due amount:

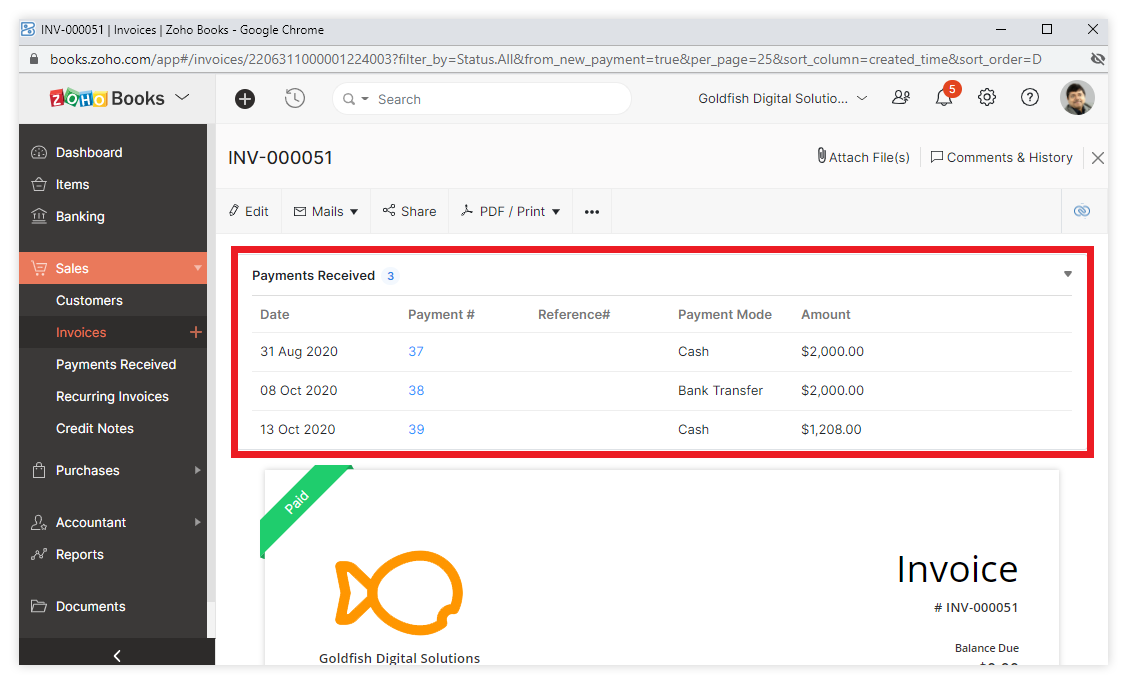

You can also see the list of all the payment details made by the customer via different modes of transaction.

This is how the final invoice looks:

Now you just need to mail it to your customer and that’s it.

See how easy it is…

Being flawless with the Invoicing process is crucial for your business, as you’re dealing with money. Also, invoices should continue to enhance customer relations by reflecting a vibe of honesty and professionalism.

With Zoho One applications, you can effortlessly streamline your invoicing process through its automated features.

You can also maintain your account details and transactions, which helps with your other interrelated business processes.

If you want to know more about how you can raise invoices via Zoho One applications, then it is time for an expert consultation!